Case Study on Remission of ABSD - How Covid-19 Relief Measure Turn into a Blessing in Disguise?

- Maine Soh

- May 19, 2020

- 6 min read

Updated: May 31, 2020

Amid the Covid-19 outbreak, I have various clients came to me for advice as they faced anxiety during this period. This is because the clock is still clicking for their remission of Additional Buyer Stamp Duty (ABSD).

What is ABSD?

For those who are not familiar with this property terminology “ABSD”, it is basically one of the cooling measures set by Singapore government.

On top of the basic buyer stamp duty, for Singaporean buying their second property or for all other nationalities and entities who wish to buy a property in Singapore will be subjected to paying ABSD.

The chart shows below are the rates and computations of the amount of ABSD payable. For Buyer Stamp Duty (BSD) rates, click here.

You may want to read my next article on the strategies to maximize your asset without paying ABSD. In this article, I would like to share more details that you need to take note of for the remission of ABSD taking my client as a case study.

What is Remission of ABSD?

Under Singapore housing policies, Singaporean married couples may apply for ABSD remission if they currently owned a residential property but has purchased another replacement home. The following condition is applicable in order to be eligible.

At least one applicant is Singaporean

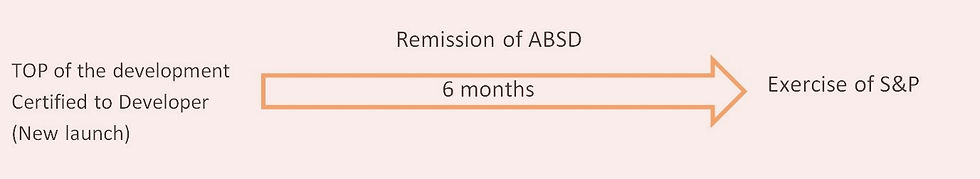

Couple must sell their first property within 6months from the TOP of new flat or within 6months from exercising of S&P for resale property

Married couple should remain married at the time of application for the remission.

Couple should not have bought more properties before the application.

Case Study:

My client Mr & Mrs Lim bought a 2bedroom unit at Star at Kovan at approximately 1.14mil back in 2015 and has incurred a 7% ABSD which is equivalent to $79,800.

This Project received TOP on 9 November 2019 but she only received key on 15 Feburary2020. One of the common misconceptions is that the remission of ABSD period kicks in within 6month from the TOP date by the developer not the collection of the key from the developer.

This means that the last date for the remission of the ABSD is 9 May 2020.

Mr and Mrs Lim engaged a three property agents from different agencies to market the unit 6 months prior to the TOP.

However, none of the agents come back to her with any feedback or offer in regards to the price of the unit. They did not provide market analysis or advice related to the pricing.

She engaged my service on February 2020. I showed her the latest transacted pricing for the unit. She was shock at first but come to a realization that her asking was not realistic. Unit being price too high is ended up as a show room for other agent to close other unit in the market.

After taking my advice, she agreed to allow me re-price the unit for her.

In a short span of 6 weeks, I manage to receive an offer despite all the rules and regulation has implemented in place for Covid -19. After much negotiation, both seller and buyer agreed at $450,000.

While I thought it is a happy ending for me and my client that i manage to solve their issue and get their remission of ABSD back in time, Circuit Breaker kicked in.

Potential buyer loses the confident to proceed to exercise the OTP due to Covid-19 gloomy economy atmosphere.

Nevertheless, it is also through experience that there are higher probabilities for HDB buy to back out from the offer as the initial commitment is very low at $1000.

Fortunately, after following up with all other viewer who manage to view before the circuit breaker, another potential buyer gave another offer for this unit at a higher price of $453,000.

However, Circuit Breaker has slowed down many process that include getting approval from HDB Loan Eligibility (HLE). Without the confirmation of the loan approval from the HDB, the potential buyer are not comfortable to put up the $1000 booking fee.

Since the timeline of 9 May 2020 to submit the application for the remission of ABSD seem impossible to achieve, they have given up and decided to rent out the unit instead of selling till a new temporary relief measure announced by the government on 6 May 2020.

Temporary Relief Measure for Individual

Singapore government recognized that Covid-19 pandemic has resulted a slowdown in the overall property market.

Thus, the temporary relief measures has been put in place for property developers and individual owners affected by the disruption to construction timelines as well as the sales of the individual property unit

With the temporary relief measures, the specified sale timeline for remission of ABSD paid on the second property will be extended by another 6 months. In order to be qualify for the extension, the couple need to meet both of the following conditions:

The second property was jointly purchased by Singaporean couple on or before 1 June 2020

The original timeline for the sale of the first property expired on or after 1 February 2020.

To find out more information about the temporary relief measure for ABSD, click here.

After informing my client about this news, my client is delighted as this means that they are still eligible to get the remission of ABSD. They are more than happy to go ahead with the offer from the buyer.

Planning Ahead

My case above is a blessing in disguise as little would we expect that Government will implement a relief measure to extend the eligibility of submission for the application of remission of ABSD.

The entire process of selling a property takes time.

Although the HDB transaction process has been shorten due to the removal of first appointment, it is recommended to start marketing the unit at least 9 months in advance.

It is worth negotiating for extension of stay than to lose the entire sum of ABSD.

Finding multiple agents to market the property does not necessary means you will be able to sell your property faster. Most often, your unit prices are being competed by the agents.

Potential buyer may deem your unit as a "desperate" unit and generally give a lower offer. The last thing you want to know is that the same buyer are offering your unit through multiple agents.

It is a stressful process especially you have a deadline to meet. I have assisted many clients throughout this process successfully by providing them with market analysis to make informed decision and prevented them from making avoidable mistake.

Do you need more clarification

I do provide a Free consultation for couples who wishes to make changes to their property portfolio but not sure how to go about it.

Click Whatapp to get in contact with me for a 1 time free 30min Property Wealth Planning (PWP) consultation.

A PWP consultation includes the following:

· A detailed financial affordability assessment

· A clear and customized investment road map for your real estate investment journey.

About Author

Maine hold a Diploma in Property Development and Facility Management as well as a Bachelor’s Degree in Real Estate from NUS.

She has been in Singapore Real Estate Consultant and Property Wealth Planner since 2009.

During the early stage in the industry,she mainly served various relocation companies. As such, upon graduation from NUS, she became very attached to this industry especially she has not only built a pool of clientele portfolio, she has also built a pool of friends whom she felt a sense of responsibility to take care of their leases or sales of their properties.

To date, her greatest fulfillment is still the capability of assisting her clients and friends to source the right property that they call home and achieving the best offer that bring smiles on their faces. She valued all the relationship that came into her life. Thus, it is common for her to go extra mile for her client whenever required.

Most of her clients trusted her as she is not only well versed with all the marketing strategy and tools, she hold them through the complex process of the transaction ensuring they make informed decision and prevented them from making avoidable mistake. Thus, her success is evident from consistent referrals from my clients and friends.

Related Reading:

Comments